Bank Frauds in India

Bank Frauds in India

Bank Frauds: An Overview

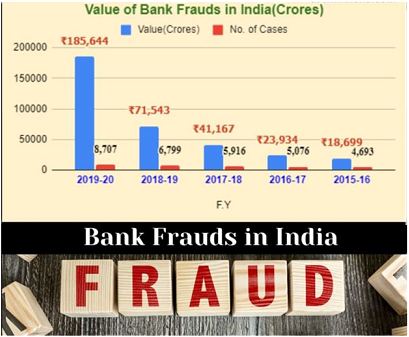

In the fiscal year of 2023, the banking system also witnessed a total of 13530 fraud cases. In May 2023, the Reserve Bank of India also highlighted the highest incidence of digital scams within the landscape of digital payments for that physical year. An enhanced perspective on the challenge reveals that between 1st June 2014 to 31st March 2023, the banks of India detected almost 6517 frauds that resulted in a staggering loss of approximately 4.69 lakh crore.

This data reported by the Reserve Bank of India has underscored the significant and prolonged implications of bank scams on the financial landscape.

Various Scams

- The Nirav Modi-PNB scam took place in 2018 which was a massive scam that should have affected the banking sector of India. Nirav Modi was a jeweller and his associates had managed to defraud the Punjab National Bank and there was a scam of approximately Rs. 11,400 crores.

- Punjab National Bank also suffered massive laws of finance which has tarnished its reputation.

- Vijay Mallya was also a flamboyant businessman who was the owner of Kingfisher Airlines and became synonymous with financial fraud in India.

- Kingfisher Airlines borrowed several sums from New York banks and failed to repay these debts.

- The charges against Vijay Mallya included embezzling funds and utilizing them for personal and commercial objectives.

- The Rotomac pen fraud case was another major scam involving Vikram Kothari and his family, who were purportedly paid as per the report.

- A sum of 3696 crore was borrowed from various banks to produce their pen. The Kothari family backed their organization's debt and invested the funds in other ventures.

- They were also found to have used the money for personal promotion, rather than focusing on business growth.

- The PMC bank scandal in India was revealed as a significant banking fraud that occurred later this year.

- It has exposed a network of financial concealing and mismanagement of non-performing assets. The modus operandi was that the loans were granted without proper collateral and appropriate diligence. Various depositors were unable to access their amounts for a comprehensive period which has caused severe hardship.

- Satyam computer scam was another major scam which was uncovered in 2009 and can be referred to as the most shocking scandal across the corporate sector of India.

- The shareholders and employees also suffered huge losses when the scam came to light. It has also enhanced the concerns regarding corporate governance along with the role of auditors in detecting such scams.

How to Mitigate these Challenges?

It is significant for considering the lessons achieved and the actions needed to secure the financial future of the nation. The banking sector needs to implement the impurity of vigilance and oversight. It is important to strengthen several regulatory frameworks that ensure stringent complaints with anti-money laundering for knowing the norms of customers. Moreover, banks in India need to invest in robust cyber security policies to safeguard the digital transactions and the data of customers. Implementation of advanced fraud detection and prevention technologies, including machine learning and artificial intelligence to recognise suspicious patterns and practices. It also helps in encouraging the integration of secured payment methods and technologies that include two-factor authentication.

Significantly, it is also observed that conducting campaigns of awareness for educating customers regarding common frauds and phishing techniques is quite significant for securing banking practices. It also helps in providing regular updates on the potential threats and preventive strategies through multiple networks that help reduce the chances of banking scams and fraud in India.

FAQ

State some of the common banking frauds in India.

Some significant banking scandals that took place in India include the Nirav Modi scam, the Rotomac pen scam, The Satyam Computer Scam and so on.

How can the public usually contribute to preventing bank fraud in India?

Public awareness is quite significant as it helps individuals to stay away form the common scams and follow several practices of banking. Vigilance and responsible behaviour of banking also contribute to the collective efforts to mitigate fraud.

How can customers verify the legitimacy of communications within the banking sector?

Customers need to verify the authenticity of the communications in the bank by contacting the bank directly utilising official contact details. It needs to avoid clicking on several links offering personal information and OTP in response to unsolicited messages.